Compliance Documents & Certificates

Introduction

You may be aware that the Government of India vide Finance Act 2021, has introduced a new section 206AB (Applicable from 1st July 2021) wherein a buyer/Service recipient is responsible to deduct TDS at a higher rate (i.e. twice the existing applicable rate or 5% whichever is higher) from the seller /service provider who:

1. has not filed the returns of income for two assessment years immediately prior to the previous year in which tax is required to be deducted, for which the time limit of filing return of income under sub-section (1) of Section 139 of the Act has expired; and

2. The aggregate of tax deducted at source and tax collected at source in his case is INR 50,000 or more in each of these two previous years.

In order to comply with the above provision, we hereby declare that we have already filed the returns of income for the previous assessment years and provision of section 206AB will not be applicable on us. We request you to deduct normal TDS from payments made to us.

The Declaration under section 206AB and ITR acknowledgment of previous two years can be checked by following the below steps-

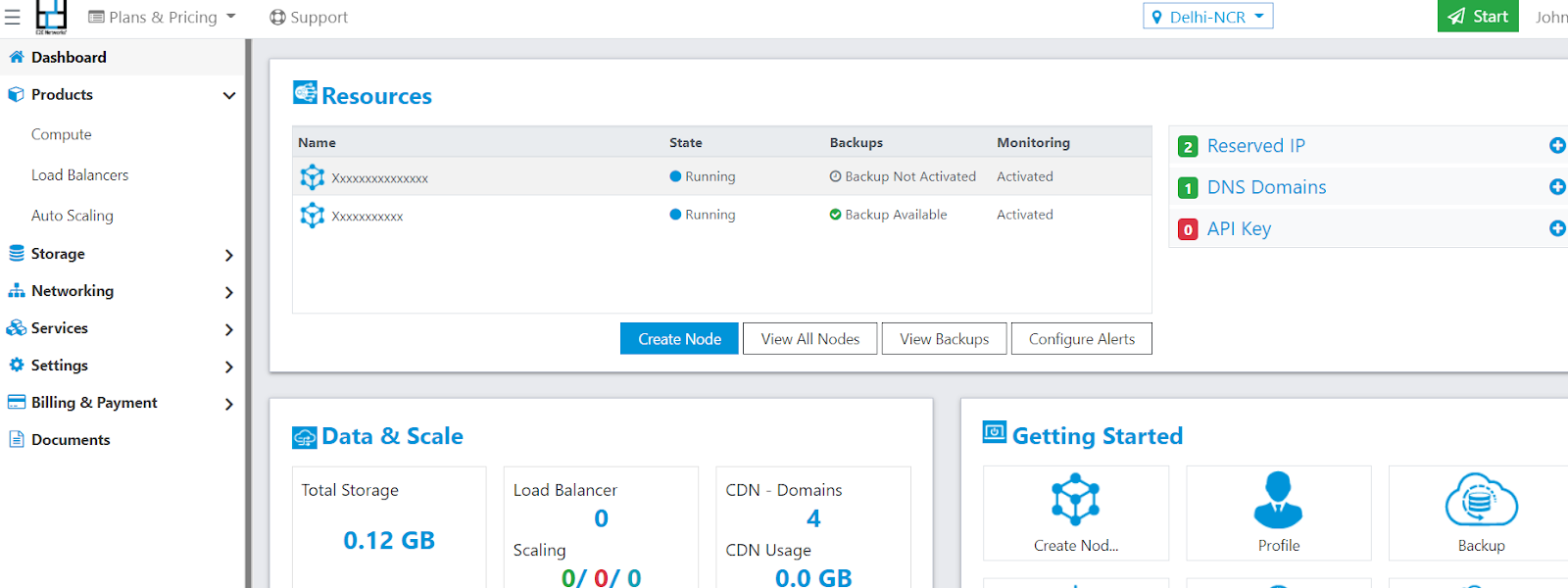

Login to MyAccount via your registered E2E Customer login Credentials.

You will be directed to the ‘Dashboard’ page.

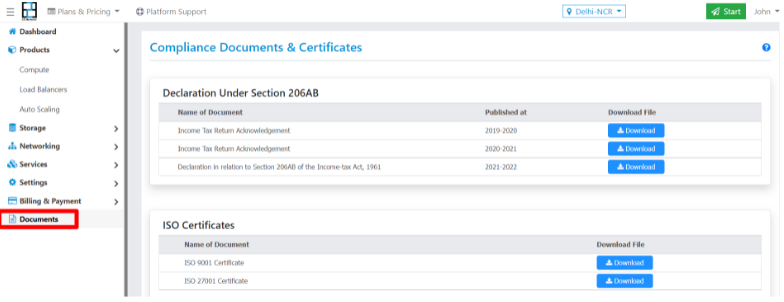

Click on the ‘Documents’ menu from the left panel menu.

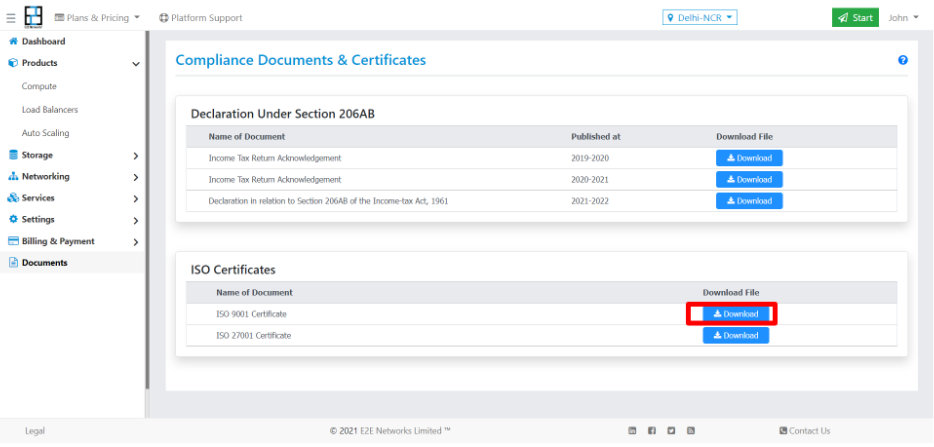

You will be directed to the ‘Compliance Documents & Certificates’ page.

Click on the ‘Download’ button to download the Declaration under section 206AB and ITR acknowledgment of previous two years

Click on the ‘Download’ button to download the ISO 9001 and ISO 27001 Certificates.

Please contact us at [email protected] if you have any queries.